Understanding the Importance of Consistent Income

Establishing a consistent income is a fundamental aspect of achieving financial stability and growth. In an increasingly unpredictable economic environment, reliance on a steady flow of income can significantly reduce financial stress. When individuals have a reliable source of earnings, they can allocate their resources with greater confidence, knowing that their basic needs will be met without the looming threat of financial uncertainty. This predictability not only alleviates anxiety but also creates a more stable foundation for both personal and family well-being.

Moreover, consistent income streams enhance an individual’s ability to save. With a regular inflow of cash, it becomes simpler to develop a disciplined saving habit. This financial cushion provides security against unexpected expenses, ensuring that one does not fall into debt during emergencies. Over time, accumulated savings can be strategically invested, leading to increased wealth and long-term financial security. Investing becomes more feasible when individuals are not continuously fretting over their immediate financial demands.

Additionally, a consistent income opens up greater opportunities for investment. Individuals are more likely to take calculated risks if they have a dependable revenue source. This willingness to invest can manifest in various forms, such as purchasing stocks, real estate, or even starting a side business. Each of these investments can contribute to future financial growth and greater wealth accumulation.

The psychological impacts of financial stability should not be overlooked. It provides individuals with the freedom to make informed life choices, enhancing their overall quality of life. With reduced financial anxiety, people are more likely to pursue educational opportunities, travel experiences, or even engage in hobbies that contribute to their personal development. In essence, establishing a consistent income is vital not only for fiscal health but also for enriching one’s life experiences and aspirations.

Exploring Money Magnet Enterprises International (MMEI)

Money Magnet Enterprises International (MMEI) is a pivotal organization aimed at empowering individuals to achieve financial independence and stability. Established with the core mission of providing educational resources and support, MMEI focuses on equipping clients with the skills and knowledge necessary to navigate the complex landscape of personal finance. The vision of MMEI is to cultivate a community where individuals feel confident in their financial decisions, fostering both personal and economic growth.

MMEI’s commitment to education is evident through its diverse range of programs and services tailored to meet the unique needs of its clientele. These offerings include financial literacy workshops, one-on-one consultations, and access to a wealth of online resources. Each component is designed to demystify financial concepts and empower participants to take charge of their financial futures. By focusing on education, MMEI believes that clients will not only be able to achieve immediate financial goals but also develop lifelong skills for sustainable income generation.

In addition to educational resources, MMEI provides practical tools and strategies that foster financial resilience. This includes guidance on budgeting, investment analysis, and debt management. The organization’s holistic approach ensures that individuals are not only informed but also equipped to implement effective financial strategies in their daily lives. Furthermore, MMEI promotes networking among clients, allowing them to share experiences and strategies, thereby enhancing their collective understanding of financial independence.

Ultimately, Money Magnet Enterprises International plays an essential role in helping individuals unlock their financial potential. The organization’s unwavering dedication to education and resource provision cultivates an environment where clients can thrive financially, ultimately leading to a sustainable and consistent income. Through its various initiatives, MMEI continues to pave the way for individuals seeking to enhance their financial well-being and achieve lasting financial success.

Income-Generating Strategies Offered by MMEI

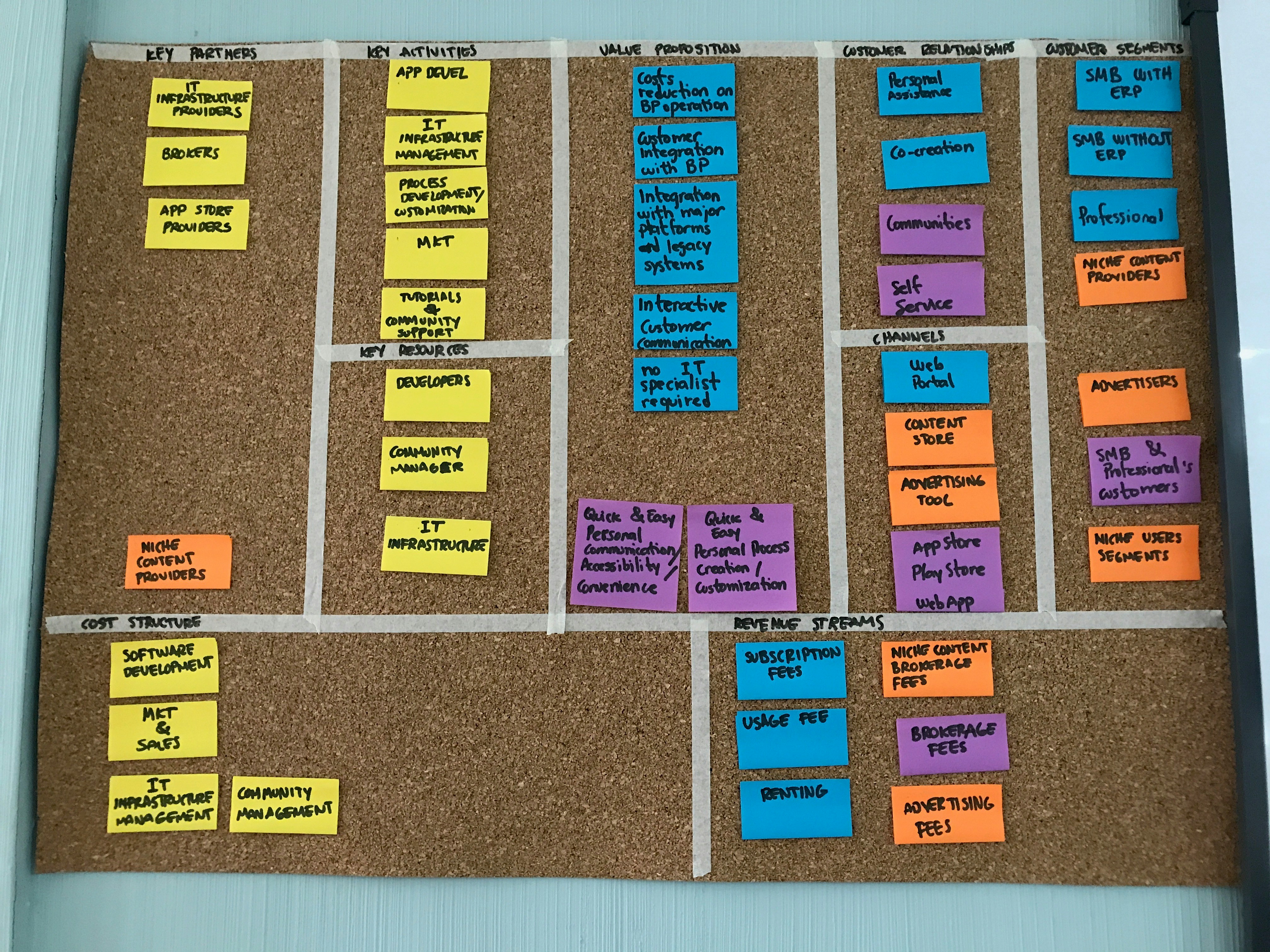

MMEI presents a comprehensive suite of income-generating strategies tailored to assist individuals in achieving financial stability. These strategies can be broadly categorized into three main approaches: passive income streams, investment opportunities, and entrepreneurship guidance. By exploring each of these categories, individuals can identify suitable methods to establish sustainable income sources tailored to their circumstances.

Passive income streams represent one of the cornerstones of MMEI’s approach. This income model is designed to generate revenue with minimal active effort after the initial setup. Examples of passive income include rental income, royalties from creative works, and dividends from stocks. MMEI provides training and resources on how to effectively create and manage these streams, enabling individuals to earn income while focusing on other pursuits.

Investment opportunities form another vital category of MMEI’s offerings. Through education on various asset classes, including stocks, bonds, real estate, and mutual funds, individuals learn to make informed investment decisions. MMEI emphasizes the importance of understanding risk versus reward, encouraging diversified investment portfolios that enhance income potential while mitigating financial risks. Additionally, MMEI offers insights into market trends, enabling participants to capitalize on investment opportunities more effectively.

Lastly, entrepreneurship guidance is a significant aspect of MMEI’s approach. MMEI equips aspiring entrepreneurs with the necessary tools to start and grow their businesses, from ideation to execution. This guidance encompasses areas such as business planning, marketing strategies, and financial management. By empowering individuals with entrepreneurial skills, MMEI fosters a mindset that prioritizes innovation and resilience, which are essential for developing a stable income flow through self-employment.

Taking Action: Steps to Establish Your Financial Future

Establishing a consistent income is a significant aspect of achieving financial stability. To embark on this journey, individuals can follow a structured approach that enables them to align their financial goals with actionable steps. The first step is self-assessment; individuals should evaluate their current financial situation, including income, expenses, and savings. This reflection helps in defining clear financial objectives that are both realistic and attainable. It is essential to establish what a stable income looks like personally, as this can vary widely among individuals.

Next, seeking assistance from resources such as MMEI can provide individuals with valuable insights and guidance on how to enhance their income streams. MMEI offers tailored advice and support that can help in navigating complex financial landscapes. Participating in workshops organized by MMEI or other financial agencies can further enhance understanding of income generation strategies. These workshops often cover critical topics like budgeting, investment opportunities, and wealth-building methods, equipping participants with the knowledge they need to make informed financial decisions.

Once individuals have gained clarity about their goals and have acquired additional knowledge, developing a personalized income-generating plan becomes paramount. This plan should outline specific actions to achieve the desired financial results, considering various avenues such as side gigs, investments, or transitioning to higher-paying job roles. Continuous learning and adaptation are crucial during this process, as market conditions and personal circumstances can change. Regularly reviewing and adjusting the financial plan will ensure that it remains relevant and effective in guiding individuals toward financial stability.

By taking these proactive steps, individuals can build a solid foundation for establishing a consistent income, ultimately leading to a more secure financial future.

Leave a Reply